The Real Cost of Contact Center Authentication: Part 3 – Member or Customer Time

In the past two posts, we’ve been looking at the expense of operations and security for banking call centers. But the cost to the credit union or community bank is only part of the picture. What about the time that members and customers have to spend on authentication?

Spending a minute or two on verification is frustrating for callers. They would rather get right to the point without having to run through a list of questions to prove who they are, especially for common requests like balance inquiries and inter-account transfers. This security Q&A process takes away from other activities that callers would much rather spend their time on. We call that an “opportunity cost.”

A Look at the Numbers for Member or Customer Time

Can we put a dollar amount on the time and opportunity cost of traditional authentication methods for the average caller? Yes, we can.

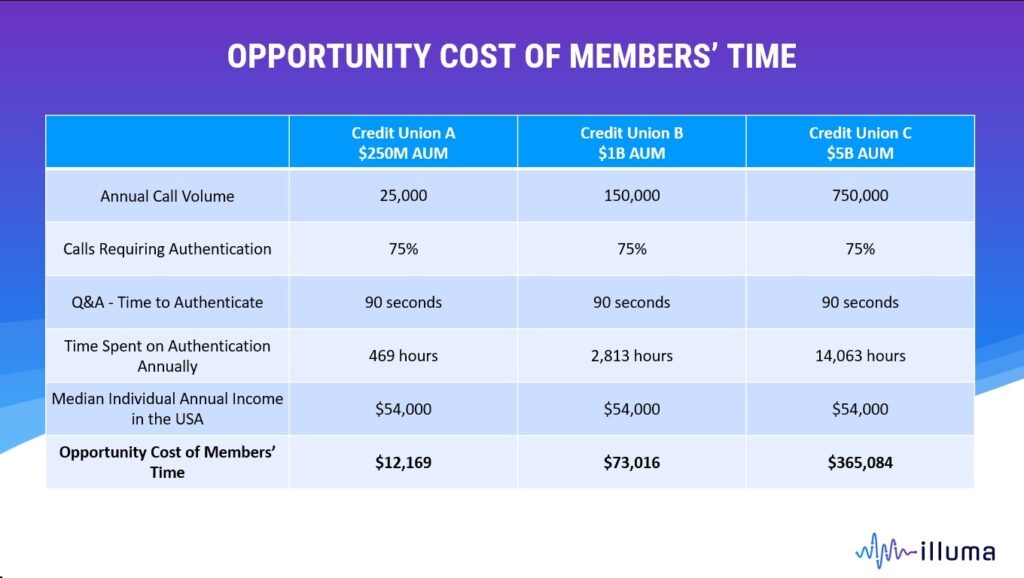

Outdated security Q&A methods used in banking call centers are creating a burden for callers. In aggregate, this can be tens or hundreds of thousands per year in opportunity costs for member or customer time. If we look at the total number of hours that members or customers spend annually going through authentication in the context of median individual income in the USA, we can see that it really does add up.

Is a Few Minutes Here or There a Big Deal?

From a member experience standpoint, it definitely is. How callers perceive their experience in the call center is an essential element in their overall evaluation of brand experience. We know that callers get impatient easily when they must wait to have their needs addressed. According to research from the SQM Group, callers will simply abandon their attempt to get through to an agent after just 2 minutes and 36 seconds. They will later call back about the same issue and end up entering their conversation with an agent in a state of frustration, feeling they have been ignored.

It’s no wonder callers balk at an extra minute and a half of answering “out of wallet” questions before they can move forward with the reason for their call. Authentication often accounts for 25% of total call time in banking call centers. That’s a significant portion of each call to spend on an activity that doesn’t add value from the caller’s perspective. They may not feel the pinch in their wallet, but they feel the time it is taking out of their day that they could spend on other, more enjoyable or productive activities.

Banking Contact Centers Can Gift This Time Back to Callers

Taking great care of members and customers includes honoring the time they spend engaging with your team. Even if it’s just a minute or two in every interaction, people feel cared for when their needs are anticipated and addressed. Cutting the time required for caller authentication is one way to have an immediate and noticeable impact on this experience.

It has the added benefit of reducing average handle times. This has the follow on effect of reducing hold times and increasing average speed to answer (ASA). As an example, Hudson Valley Credit Union cut its ASA by 30% and abandonment rate by over 50% within months of deploying Illuma Shield™ voice biometrics to replace security Q&A in their contact center.

Up Next: The Real Cost of Voice Authentication

We’ve looked at a wide variety of measurable financial costs of traditional authentication. It’s time to review the flip side of this conversation.

- What is the return on investment for switching to voice authentication?

- How much does it cost to get a state-of-the-art system in place?

- How much money can be saved based on the size of your credit union or community bank?

- How fast is ROI realized and how should it be measured?

In our final post in this series, we’ll answer these questions and more…

Want to explore these costs for YOUR banking contact center now? Contact us to help you run the numbers.