The Real Cost of Contact Center Authentication: Part 4 – ROI for Voice Authentication

February 20, 2024 | Contact Center Optimization

Throughout this series, it’s become clear that there is no such thing as “free” when it comes to authentication. Traditional verification processes come with many hidden costs to banking call centers and those they serve. But how does it compare to the cost of replacing security Q&A with more modern voice authentication technology?

Most credit unions and community banks don’t have a massive budget available for digital transformation. This means ROI for voice verification needs to be rapid and undeniable. Voice authentication solutions that cost seven figures and take months to deploy are difficult to justify from a budget standpoint, especially if adoption is slow.

Illuma Shield™ Is the Most Cost-Effective Option

Fortunately, passive voice authentication from Illuma is different. It is designed to provide easy access for contact centers of any size:

- Affordable pricing for state-of-the-art technology

- Rapid, low lift deployment with full support (implementation often takes just an afternoon with go-live in 2-3 weeks with little internal effort)

- High adoption for members and customers (over 95% opt-in is common)

- Enhanced security to reduce the risk of fraud losses

- Positive financial impact on operations within the initial months of deployment

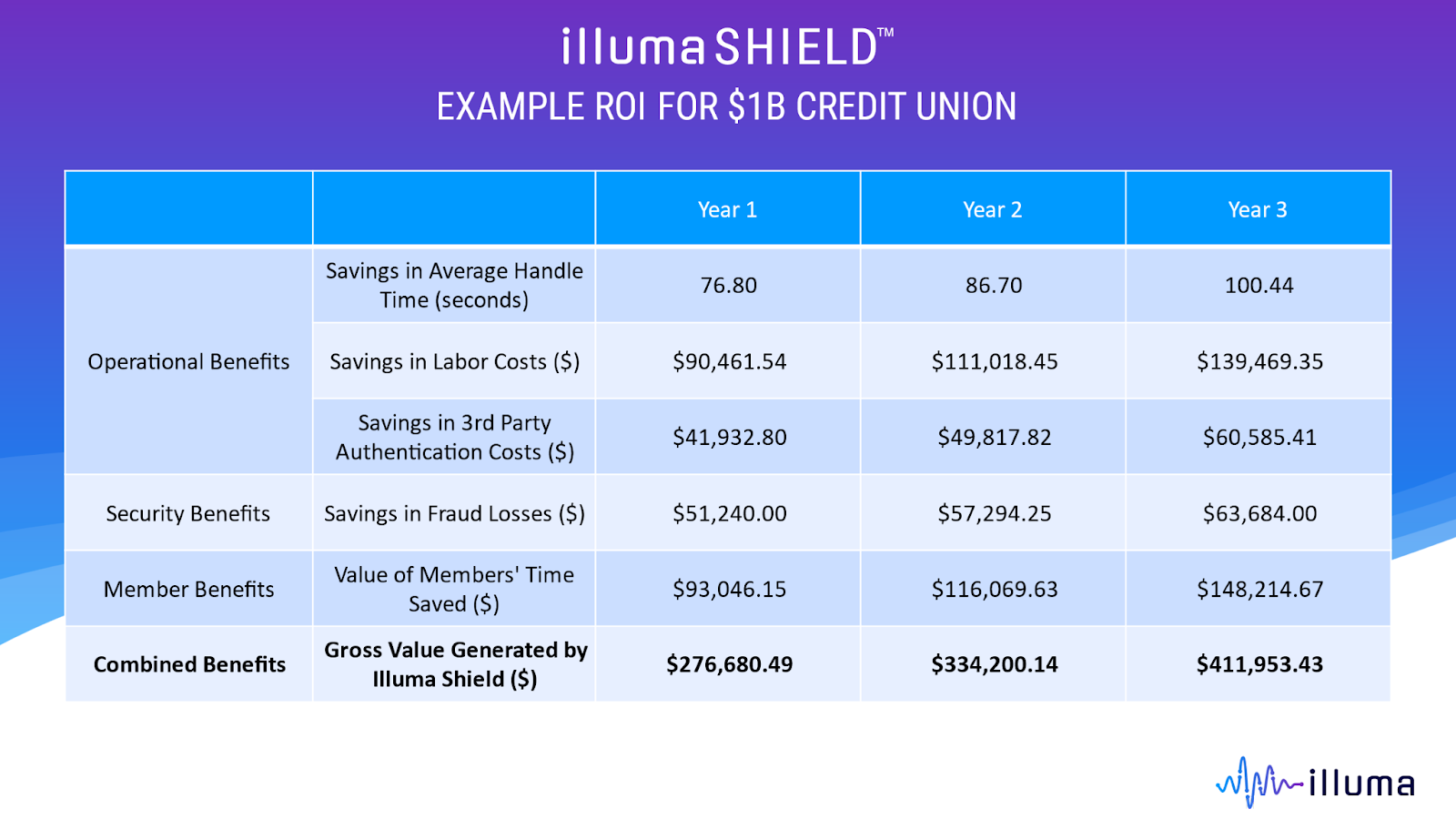

A Look at the Numbers – Value Delivered in Years 1 through 3

For example a credit union with 1B in AUM, the total value generated in year one is typically a quarter of a million dollars or more. These savings include operational costs such as labor and step-up 3rd party authentication. The ROI also reflects the reduction in fraud loss as well as the value of the time members save by skipping Q&A on calls.

How Much Does Our Voice Authentication Cost?

Community financial institutions are often under the impression that voice authentication technology is cost-prohibitive from a budget and resources standpoint. That’s not surprising because some well-known solutions on the market cost over a million dollars and take many months to implement.

However, Illuma’s solution has been designed from the start to be affordable even for small credit unions and banks. The typical first year cost of Illuma Shield is far lower than the value generated for the institution and very little internal IT resources are required for rapid deployment. This value continues increasing year over year, making voice verification technology a high ROI step in the digital transformation journey.

Why Does ROI Keep Increasing Year over Year?

Adoption rates drive increasing ROI over time. We find that tens of thousands of members or customers typically enroll in the first few months of use, and enrollment numbers continue to rise as more callers are given the option through the contact center.

What about the labor costs for internal IT teams? Initial deployment takes weeks, not months, and is driven and supported by Illuma. The initial lift for Internal IT departments is low.

The ongoing effort is also low. Here is what our clients say about the resources required to maintain the system:

“The ongoing resources needed to manage the Illuma platform are minimal. Unless we’re in the midst of a project or upgrade, I don’t even think about the platform between our bi-weekly meetings because it just works the way it’s intended to.”

“We haven’t added anyone to purely support, and no-one has indicated the slight added workload is a strain. IT involvement has been minimal on an as-needed basis.”

What about ROI for Smaller Financial Institutions?

Small financial institutions are particularly vulnerable to the impact of even a few members or customers having a bad experience. Reducing this risk to reputation and protecting against financial losses is top of mind for many of the banks and credit unions we encounter. Being able to provide frictionless authentication and prevent account takeovers is a win, and the ROI is still excellent even at a relatively low call volume.

We are finding that even small banking contact centers choose Illuma Shield™ because the impact on member/customer experience and the reduction in fraud risk is well worth the investment. We believe every banking contact center deserves to have access to the newest technology for voice authentication and remain committed to providing the most affordable and effective solution for our customers. Unlike solution providers that only serve big banks, we never turn a financial institution away if they want to explore our platform.