The Real Cost of Contact Center Authentication: Part 1 – Operating Costs

November 20, 2023 | Contact Center Optimization

What hidden costs are draining community financial institutions if they continue to use out-of-wallet questions for caller verification in the contact center?

At Illuma, we speak with leaders at credit unions and community banks every day about improving their caller authentication processes through the power of voice biometrics. And as with any decision around digital transformation, there is an investment involved in making a change. There needs to be “room in the budget” for voice authentication technology for it to be feasible. That’s a reasonable concern. At the same time, there is also a cost to maintaining the status quo. It’s just hidden from view.

In this series on “The Real Cost of Contact Center Authentication”, we will give examples of how several categories of costs from operations to security to member experience impact financial institutions of all sizes. This is a big piece of the puzzle when it comes to determining the ROI on voice authentication software.

Part 1: Operating Costs of Traditional Authentication

Time is money when you are paying call center employees to walk callers through a step-by-step verification process. The time it takes to simply validate that a caller is who they say they are is enormous. Let’s begin with a quick look at how Knowledge Based Authentication (KBA) impacts operating expenses. A few statistics will help.

- Over 75% of incoming calls require identity verification

- Typically, over 25% of agent/caller interaction is verification

- $12B in spent on caller authentication in the U.S. every year

That’s a lot of money going toward time-consuming KBA.

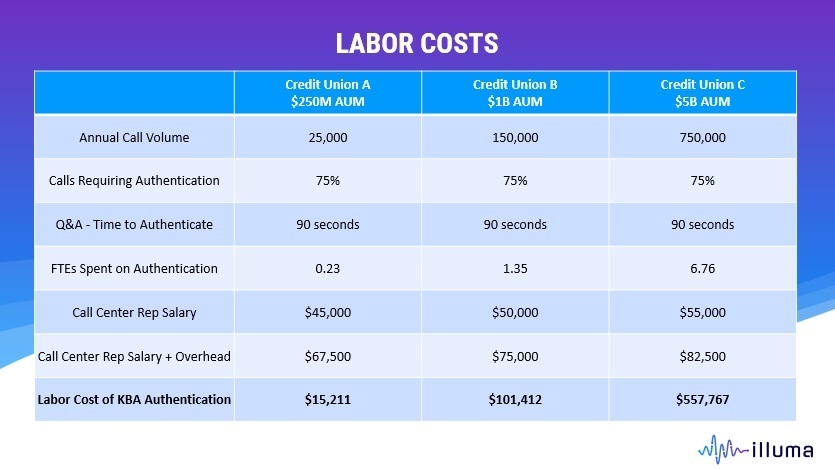

Of course, financial institutions vary in size. So, what does that cost add up to for a small organization vs. a large one? Is there a minimum size of organization below which having a lengthy member verification process really isn’t costing your organization very much in terms of labor hours and overhead? How do you calculate your break even point?

Since we work with credit unions and community banks of various sizes, we’ve done the math for you. For an institution with $250M AUM, the labor cost of KBA alone is over $15,000 per year. For one with $5B AUM, it can easily exceed half a million.

Across the organizations we speak with, most spend 1.5 minutes or more on almost every phone call asking security questions. It’s one of the most inefficient activities that contact center agents spend their time on as part of their day to day job. (In Part 2 of this series, we’ll explore why it’s also increasingly ineffective.)

Operational Efficiency Is More Important Than Ever

Call volume increased dramatically during COVID and will likely never return to pre-pandemic levels. At the same time, the talent pool for call center agents is not getting deeper. Contact center talent acquisition and retention remains a critical problem in the banking sector. Most organizations can’t hire their way out of this problem, even if they have the budget to do so. There has to be a better way.

Above and beyond the high operating expense of old-fashioned KBA, financial institutions also have costs around security and fraud. In our next installment, we’ll uncover those and explore the impact. Stay tuned!

Want us to help you run the numbers for YOUR community financial institution? Book a time to talk.

1.Johnson, Alicia. “25 Stats That Indicate the Recent Trends in Contact Center Industry.” Blog post. Fusion BPO Services, 2014. Web.

2.Litan, Avivah. Absolute Identity Proofing Is Dead; Use Dynamic Identity Assessment Instead. Gartner, Inc., 16 Nov. 2015